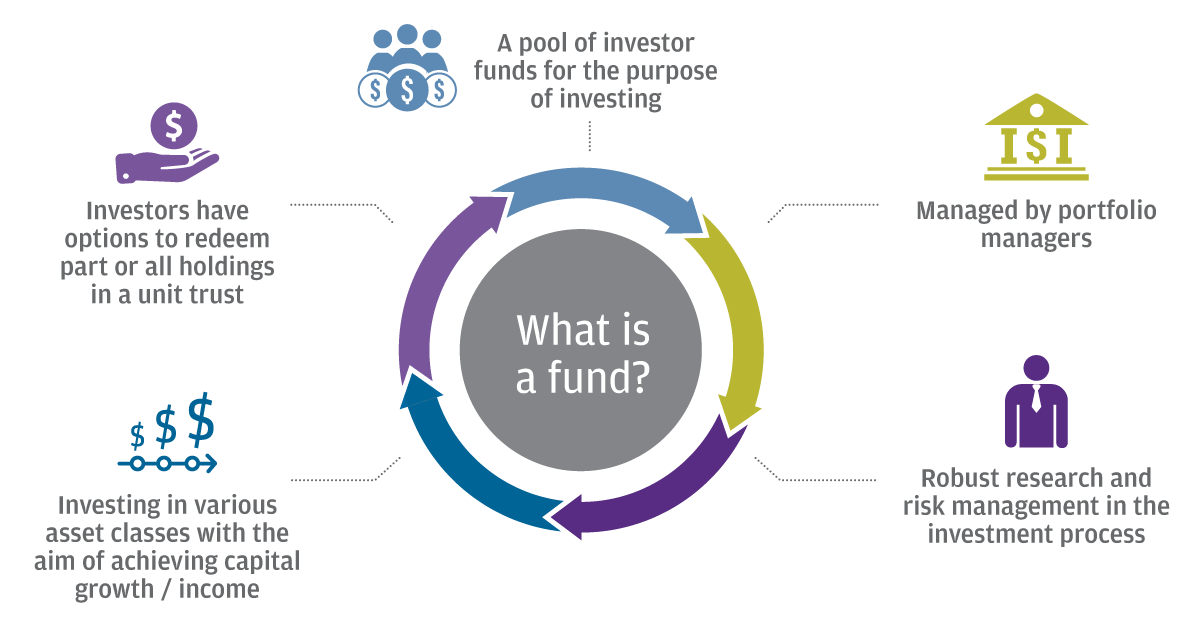

Unit Trust Funds UTFs are Collective Investment Schemes that pool funds from different investors and are managed by professional fund managers. While the boards of.

10 Differences Between Mutual Funds Mfs And Unit Investment Trust Funds Uitfs The Wise Living

The fund managers invest the pooled funds in a portfolio of securities with the aim of generating returns to meet the specific objectives of the fund.

. For example suppose an investor redeems 50000 from a traditional Standard Poors 500 Index SP 500 fund. This page shows all the Schemes of HDFC Mutual Fund across Equity Debt and Hybrid categories. UTI Mutual Fund is one of the leading mutual fund investment companies in India.

HDFC Balanced Advantage Fund-Growth is a Dynamic Asset Allocation mutual fund scheme from Hdfc Mutual Fund Dynamic Asset Allocation funds charge. Infrastructure investment trusts are investment instruments that work like mutual funds and are regulated by the Securities and Exchange Board of IndiaAbbreviated as InvITs their units are listed on different trading platforms like stock exchanges and are a wholesome combination of both equity and debt instruments. A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate.

Out of 69 mutual fund schemes offered by this AMC 6 isare ranked 5 7 isare ranked 4 14 isare ranked 3 8 isare ranked 2 2 isare ranked 1. A type of investment that pools shareholder money and invests it in a variety of securities. Trustees Trustees Created through a document called the Trust Deed that is executed by the Fund Sponsor and registered with SEBI.

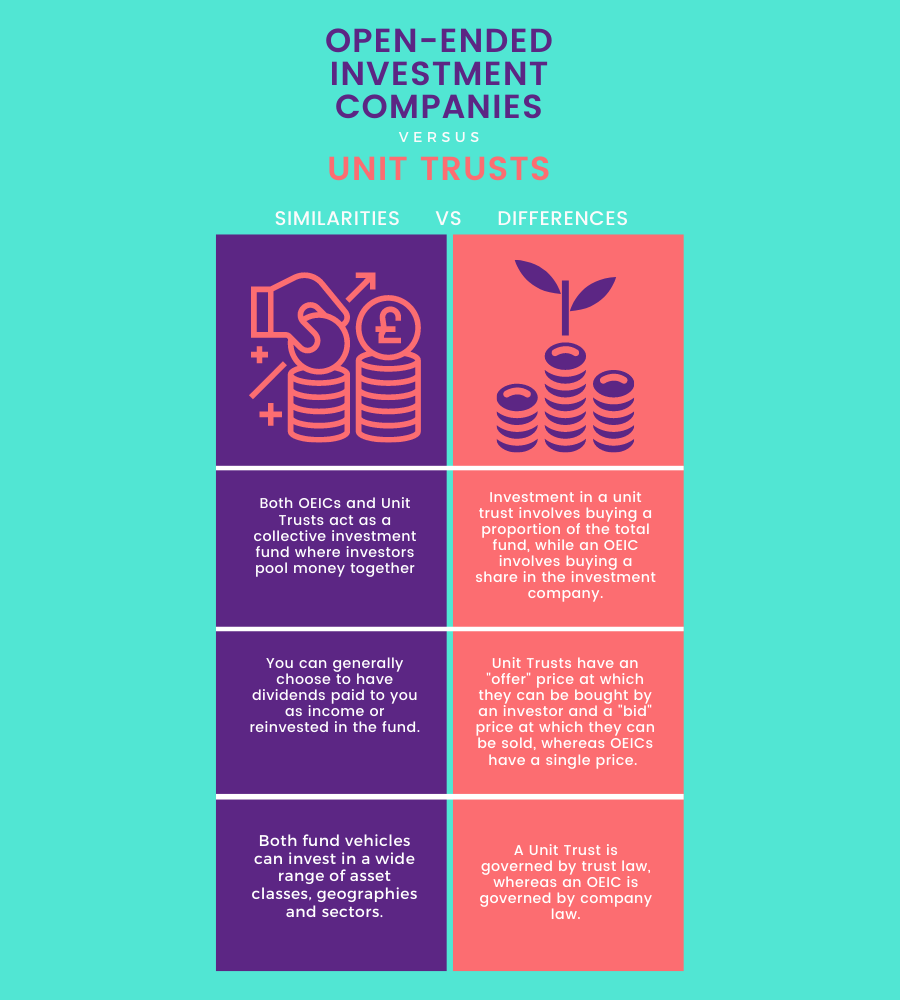

Here is a list of the pros and cons of open. Free ratings analyses holdings benchmarks quotes and news. The Trust- the Mutual Fund may be managed by a board of trustees- a body of individuals or a trust company- a corporate body.

The underlying mutual fund collective trust or ETF has the right to restrict trade activity without prior notice if a participants trading is determined to be in excess of their exchange policy as stated in the prospectus or offering memorandum. Learn everything about First Trust NASDAQ Technology Dividend Index Fund TDIV. Retail investors Retail Investors A retail investor is a non-professional individual investor who tends to invest a small sum in the equities bonds mutual funds exchange-traded funds and other baskets of securities.

Roles and Responsibilities of CXOs. By the end of the 1900s ICA turned into an open-end mutual fund. Currently the fund has a 6970 allocation to equity and 2246 to Debt.

ETF Redemption Example. An open ended mutual fund has multiple advantages but they have some limitations that investors should know about. The primary objective of InvITs.

Read more who have limited savings for investment. Invest in all types of mutual fund schemes online with UTI AMC today. The Trust-the mutual fund may be managed by a Board of Trustees- a body of individuals or a Trust Company- a corporate body.

At Old Mutual Insure we believe in the power of connecting with our customers in real and meaningful ways through our Magical Moments. They often take the services of online or traditional brokerage firms or advisors for investment decision-making. Unit Trust - UT.

About HDFC Balanced Advantage Fund. It became a publicly-owned closed-end fund in 1933 becoming operational under Capital Group by 1934. More Funds from HDFC Mutual Fund.

HDFC Balanced Advantage Fund-Growth returns of last 1-year are 1683. To pay the investor the fund must sell. Each investor owns shares of the fund and can buy or sell these shares at any time.

Most of the funds in India are managed by Boards of Trustees. Mutual funds are typically more diversified low-cost and convenient than investing in individual securities and theyre professionally managed. Following the release of the Capital Markets Authority CMA Quarterly.

The information shown is based on the most recent available information for the underlying mutual fund collective trust or ETF collectively. Pertinent information on the Schemes like NAV Expense Ratio 1 Year Return Assets under Management Style Box and most importantly Scheme Ratings are shown in the page. Equity Style box shows Fund Valuation in the X axis and Market.

Mutual Fund vs. The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. A Trust is created through a document called the Trust Deed that is executed by the fund sponsor in favour of the trustees.

Protector of unit holders interests. Most countries laws on REITs entitle a. A unit trust is an unincorporated mutual fund structure that allows funds to hold assets and provide profits that go straight to individual unit owners instead of reinvesting them.

Malaysia business and financial market news. A unit investment trust UIT is a type of investment that offers a fixed portfolio of stocks bonds and other assets for a set period of time. Since launch it.

23 of the trustees shall be. Brokers Advisers 0860 63 73 73 Direct Customers 0860 22 55 63. The words Personal Finance.

Free ratings analyses holdings benchmarks quotes and news. Learn everything about First Trust Cloud Computing ETF SKYY.

Finayu Consultancy What Is Unit Trust Ut A Unit Trust Is An Unincorporated Mutual Fund Structure That Allows Funds To Hold Assets And Provide Profits That Go Straight To Individual Unit

Etf Vs Unit Trust What S The Difference

Etfs Vs Unit Trusts Mutual Funds In Malaysia Dividend Magic

Sg Finance Savvy Unit Trust Vs Mutual Funds Vs Etfs Cpf Part 4 Cpfis Provides Us With Many Investment Vehicles And Options To Invest Our Cpf O A And S A In

Mutual Funds For Beginners J P Morgan Asset Management

Ano Ang Pinagkaiba Ng Uitf At Smart Pinoy Investors Facebook

Things To Know Before Investing In A Mutual Fund Forbes Advisor India

Etf Vs Mutual Fund Vs Unit Trust What Are The Differences

Get To Know The Difference Between Manulife Philippines Facebook

Unit Trust Vs Mutual Fund Georgiartl

Which Mutual Fund Or Uitf Should You Invest In Budgeting Money Investing Mutuals Funds

Unit Trusts Vs Investment Trusts The Compensation Experts

رفيده فرحانه On Twitter The Difference Between Unit Trust Equity And Individual Stocks Is How We Purchase Acquire The Ownership Let S Take An Example Aminah Dreams To Own Stocks Equities In These Big Companies

Should People Really Trust Mutual Funds Quora

3 Reasons Why Stocks And Etfs Are Not The Only Ways To Start Investing Dollardex

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

Mutual Funds Different Types And How They Are Priced

Etf Vs Unit Trust What S The Difference

What Is The Difference Between A Mutual Fund And A Unit Investment Trust Fund Helpdesk Page

Investment Trusts Vs Unit Trusts Adviser Schroders